When it comes to managing your finances, finding the best bank for checking account services can make all the difference. In today’s fast-paced world, having a reliable checking account is essential for day-to-day transactions, budgeting, and even saving for the future. With a myriad of options available, from traditional brick-and-mortar banks to online-only institutions, knowing which bank suits your needs best is crucial. This article will delve into the various factors to consider while searching for the best checking account and provide insights into some of the top contenders in the market.

In a landscape where fees, interest rates, and accessibility can vary significantly, understanding what is available can empower you as a consumer. Are you looking for low fees, high interest rates, or user-friendly digital banking features? By answering these questions, you can narrow down your choices and make an informed decision about where to open your checking account. Additionally, we will explore the benefits and drawbacks of each option, helping you find the best bank for checking account services that align with your financial goals.

Moreover, it’s important to look beyond just the basic features of a checking account. Consider additional offerings such as savings accounts, customer service quality, and even financial education resources that many banks now provide. As you embark on this journey to find the best bank for checking account services, let’s dive deeper into what makes a checking account truly beneficial for your personal finance management.

What Features Should I Look for in the Best Bank for Checking Account?

When searching for the best bank for checking account services, it's essential to keep an eye out for several key features. Here are some factors to consider:

- Fees: Look for banks with low or no monthly maintenance fees.

- ATM Access: Ensure there’s a wide network of ATMs available.

- Online Banking: A user-friendly online and mobile banking experience can enhance your banking experience.

- Interest Rates: Some checking accounts offer interest on your balance, providing additional benefits.

- Customer Service: Quality customer support can be invaluable when you encounter issues.

Are Online Banks the Best Bank for Checking Account Options?

Online banks have become increasingly popular due to their competitive interest rates and low fees. But are they really the best option for checking accounts?

Advantages of online banks:

- No or low monthly fees

- Higher interest rates

- Convenient mobile apps for banking on-the-go

However, it’s essential to consider the potential downsides:

- Limited ATM access

- Less personal interaction when needing assistance

What Traditional Banks Are Considered the Best for Checking Accounts?

If you prefer the traditional banking experience, here are some banks known for their checking account options:

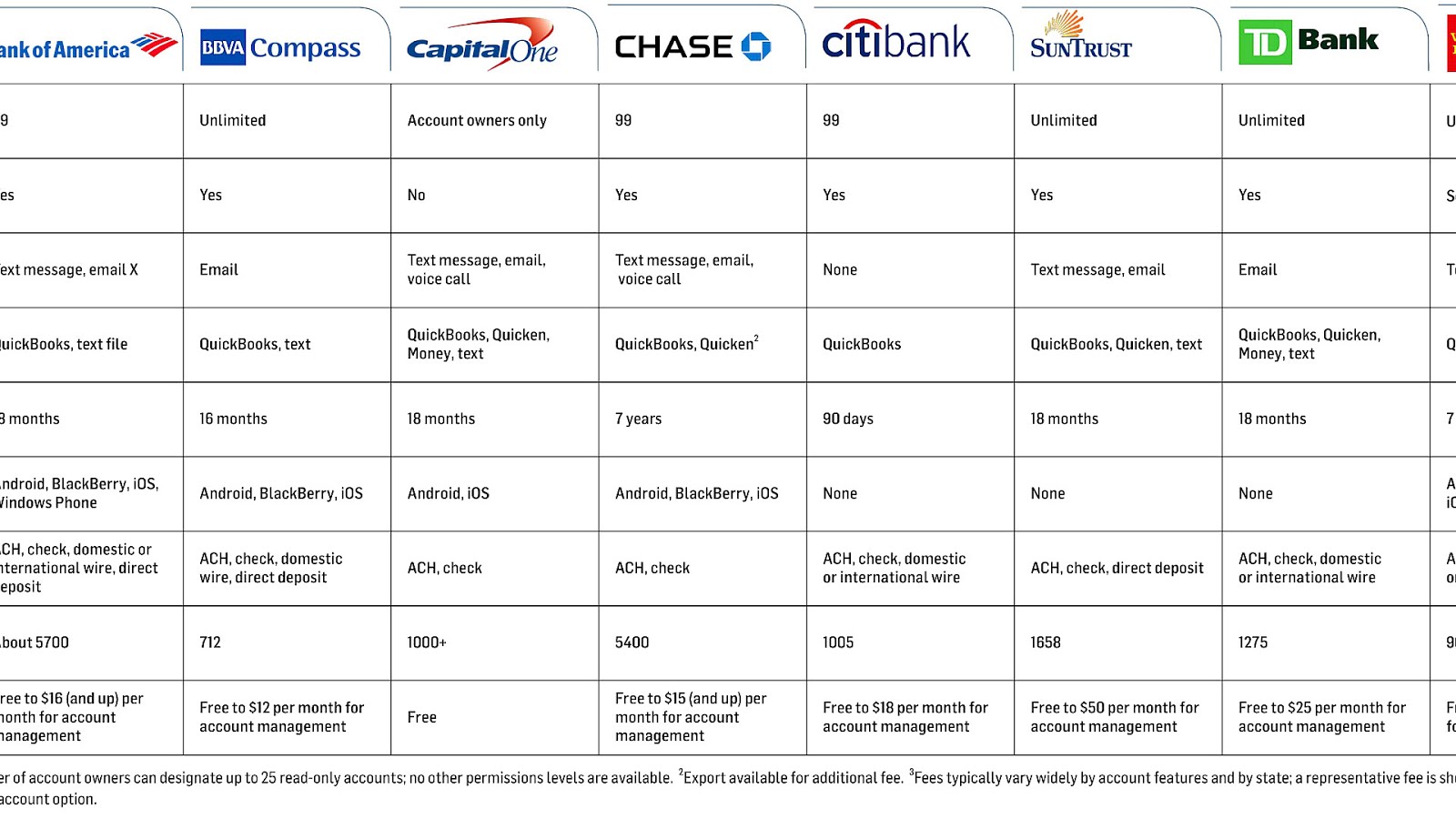

- Chase Bank: Offers a wide range of checking accounts with numerous branches.

- Bank of America: Known for its extensive ATM network and customer service.

- Wells Fargo: Provides various checking account options with unique features.

How Do Credit Unions Compare as the Best Bank for Checking Account Services?

Credit unions are another option to consider when searching for the best bank for checking account services. Often, they offer lower fees and more personalized service. However, membership is typically required, which may limit access for some individuals.

Benefits of credit unions include:

- Lower fees and better interest rates

- Community-focused service

- Personalized customer support

What Are the Best Checking Account Promotions Right Now?

Many banks offer promotions to attract new customers. Some of the best checking account promotions include cash bonuses for opening an account and maintaining a certain balance. Always read the fine print to understand the requirements.

Examples of current promotions:

- Bank of America: $200 bonus for new accounts.

- Chase: Up to $300 bonus for new checking accounts.

How Do I Choose the Best Bank for Checking Account Based on My Lifestyle?

Your lifestyle plays a significant role in determining which bank is the best for your checking account. If you travel frequently, you may prefer a bank with a vast ATM network. On the other hand, if you mainly use online banking, you might prioritize digital features over physical branches.

What Are the Common Mistakes to Avoid When Opening a Checking Account?

When selecting a checking account, it’s essential to avoid common pitfalls:

- Not reviewing the fee structure.

- Ignoring the interest rates offered.

- Overlooking ATM access and branch locations.

Can I Switch Banks Easily If I Find a Better Option?

Switching banks is generally a straightforward process, but it requires careful planning. Ensure you update any automatic payments and direct deposits to your new account to avoid issues. Most banks provide assistance during the transition to help you switch seamlessly.

Conclusion: Finding the Best Bank for Your Checking Account

Ultimately, the best bank for checking account services will depend on your individual needs and preferences. By considering the factors outlined in this article, you can confidently make an informed choice that aligns with your financial goals. Whether you opt for an online bank, a traditional institution, or a credit union, the key is to ensure that your checking account serves you well in managing your finances effectively.

Article Recommendations

- Key Facts About Henry Hudson A Renowned Explorer

- Illuminating The Path Of Laughter The Impact Of A Black Comedian

- Mitch Mcconnells Blocked Bills Gif List Hilarious Highlights